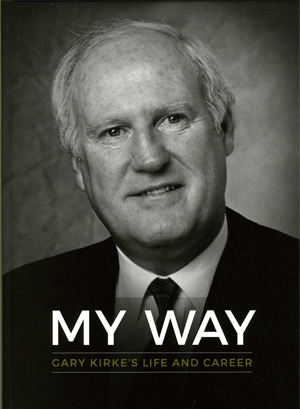

Born in 1943, Gary Kirke was tail gunner in a family of nine children born to a life insurance salesman and a “shop girl” in Des Moines, Iowa. As the youngest, he “got away with murder,” according to a sister. He did have a certain free-range quality about him, and a tendency to get in trouble. The Dominican nuns at his grade school helped to tame him a bit, and he loved them forever in return.

Gary had an eye for innovation and the self-confidence to follow his own path. He bailed out of a training program at a big insurance company once he realized that almost nobody was selling group insurance to associations.

He saw the potential and put everything he had into developing this new clientele. His success impressed everyone, including the world’s largest insurance broker, which bought Gary’s company for well over $200 million.

This was just the first of a series of entrepreneurial bets Gary has placed on wildly divergent industries, including medical technology, carbon fiber products, and casino gaming and hospitality.

Gary Kirke’s story is unique and inspirational. It’s about hard work, good timing, appreciating what you’ve got, and making your own luck if it doesn’t show up on its own.

I noticed that lawyers had started suing each other, and I saw another potential market

I noticed that lawyers had started suing each other, and I saw another potential market