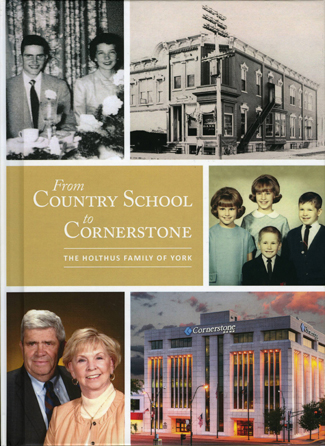

Kelly Holthus got his start in banking at an early age, and he started at the bottom of the ladder — posting checks in the back room of a country bank in Bertrand, Nebraska. He never left the region; he just worked hard and paid attention and got lucky and kept at it.

His luckiest move was taking a job with the First National Bank of York (Nebraska), which was controlled by Elijah “Lige” Leavitt, a Russian immigrant who found his way to York in 1913 and proved to be a sharp businessman.

When Kelly arrived in York in 1965, Leavitt held a controlling interest in the bank.

“Lige was my mentor; he taught me how to conduct business,” Kelly said. “He used to tell me, ‘If you take care of the people, the profits will take care of themselves.’”

Those words of wisdom turned out to be true. Kelly’s family now owns the enterprise, renamed as Cornerstone Bank, which has spread to 33 locations in central Nebraska.

A peek inside

Words from the client

“I wanted to do this book so that my grandkids will know how our family got to where we are. If we don’t save the stories that show what it takes to succeed and what values have been important to us along the way, they may take it all for granted.”

— KELLY HOLTHUS

There are plenty of ways to succeed in life, and plenty of ways to define what success means. For Kelly and Virginia Holthus, it's not very complicated. Success reveals itself in an average day, which begins early, just like it did on the farms where they grew up.

There are plenty of ways to succeed in life, and plenty of ways to define what success means. For Kelly and Virginia Holthus, it's not very complicated. Success reveals itself in an average day, which begins early, just like it did on the farms where they grew up.